jersey city property tax calculator

Calculation of income tax. For comparison the median home value in Ocean County is.

Where Are Real Estate Taxes Lowest And Highest The New York Times

Ad Just Enter your Zip for Property Values By Address in Your Area.

. Box 2025 Jersey City NJ 07303. Jersey City establishes tax levies all within the states statutory rules. Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables.

All real property is assessed according to the same standard. Homeowners in New Jersey pay the highest. How Your New Jersey Paycheck Works.

For comparison the median home value in Jersey County is. There is also an exemption threshold where you dont. New Jerseys real property tax is an ad valorem tax or a tax according to value.

Your employer uses the information that you provided on your W-4 form to. General Property Tax Information. Free Comprehensive Details on Homes Property Near You.

Enter Your Salary and the Jersey. TO VIEW PROPERTY TAX ASSESSMENTS. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving.

Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. Your yearly tax is calculated based on your total taxable income in the year less any deductions you can claim. Below 100 means cheaper than the.

New Jersey Property Tax Calculator How Are NJ Property Taxes Calculated. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Expert Results for Free.

Estimate Property Tax Our New Jersey Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. Online Inquiry Payment.

The tax rate for The Oakman is calculated based on current variable factors that may. Property Tax Calculator - Estimate Any Homes Property Tax. Box 2025 Jersey City NJ 07303.

Left click on Records Search. The total amount of property tax to be collected by a town is determined by its county municipal. City of Jersey City.

Total Tax Savings Years 18-20. New Jersey Property Taxes Go To Different State 657900 Avg. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Federal income taxes are also withheld from each of your paychecks. Under Tax Records Search select.

189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per year for a.

![]()

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

New York Property Tax Calculator 2020 Empire Center For Public Policy

U S Cities With The Highest Property Taxes

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Property Tax Calculator Property Tax Guide Rethority

Here S The Average Property Tax Bill In Newark Newark Nj Patch

New Jersey Property Tax Calculator Smartasset

Tax Collector S Office City Of Englewood Nj

Nj Division Of Taxation Sales And Use Tax

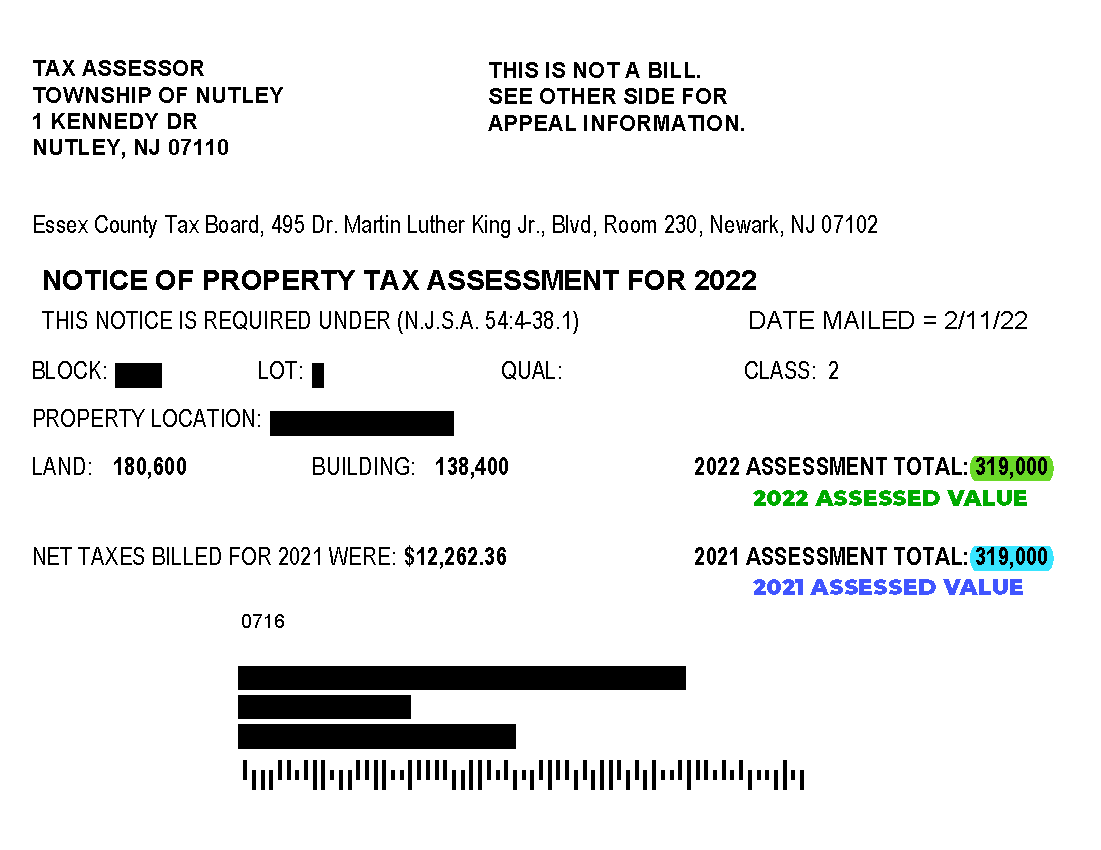

Township Of Nutley New Jersey Property Tax Calculator

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

Property Tax Calculator Smartasset

Nj Property Tax Relief Program Updates Access Wealth

Connecticut Property Tax Calculator 2022 Suburbs 101

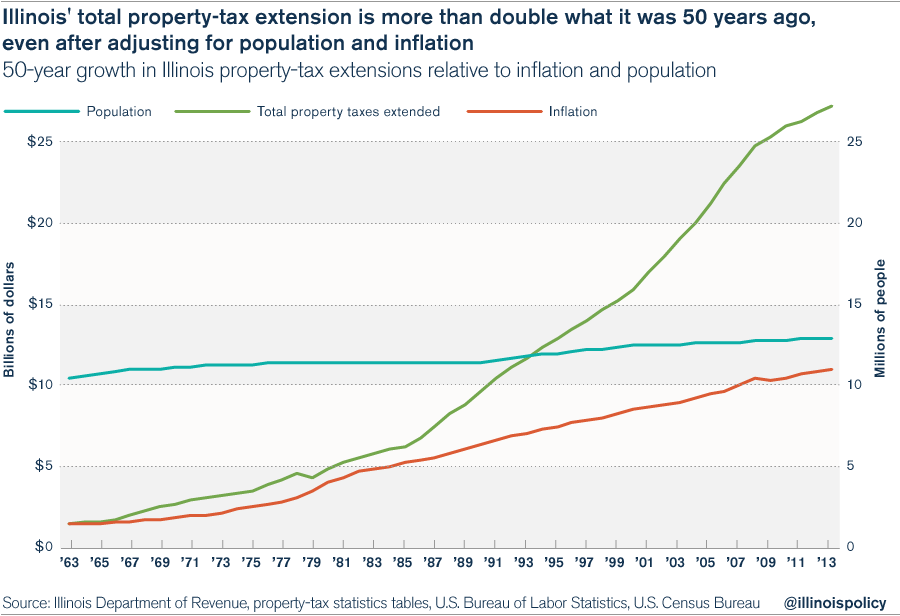

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

An Overview Of The New Jersey Exit Tax Vision Retirement

Calculator Shows Possible Tax Increase Of Illinois Labor Amendment Illinois Thecentersquare Com